Wednesday, August 31, 2005

Semester Kickoff

Welcome, unctuous expressions. I hope we can learn something. And have fun.

Monday, August 29, 2005

Repatriation?

(Having said that) I'm not too excited with this whole idea about export repatriation.

Think about your home. What happens if you close the door? You can't go out, and .... neither one can come in. How to close the door effectively? Use the best lock. Otherwise, hire the best guard in town. My point is, repatriation will lead to reciprocity. And besides, monitoring costs are high.

Reshuffle?

Hey, you asked me to opine.

Tuesday, August 23, 2005

Thank you, high oil price!

The very high oil and gas prices have led to:

- Billions of dollars invested in petroleum production. Supply will increase.

- Chevron, Marathon, and many others are opening millions acres for drilling.

- Oil and gas explorations create jobs in Rusia, Angola, China, Algeria, Britain, India, Canada, Azerbaijan, Nigeria, Poland, Malaysia, New Zealand, and Trinidad-Tobago.

- The number of exploratory rigs around the world hit record high level since 1986.

- Companies in South Korea, China, Singapore, and the US are building new hardaware to address drilling-rig shortage.

- Chevron is expanding its refinery in Mississippi by 25 percent.

- Kinder Morgan and Sempra are going to spend $3b on pipeline delivering natural gas from the Rockies to the Midwest and East.

- Valero and ConocoPhillips are improving their ability to process sour crude that is cheaper than sweet crude.

- Thai Oil is spending $1b on new ouput capacity.

- Brazil in planning to increase processing capacity by 20 percent.

- Florida is building 750MW-worth of wind-powered electricity generation.

- China and India have doubled their refining capacity.

- Everywhere people reduce unnecessary driving and encouraging fuel efficient cars and public transportation.

- Sales are soaring for hybrid vehicles.

Monday, August 22, 2005

Wife Attack!

And this one case is special. My very own wife is "attacking" me. To avoid endless debate -- see, I am a bad explainer -- I suggests her instead to read my regular columns in this magazine.

Monday, August 15, 2005

Economic Principals is no blog -- it should not

Keep up the good work, Dave!

Wednesday, August 10, 2005

Unfair Diplomas

Different?

I recently raised a concern to some collegues. On examining two master's thesis defense, I was surprised by the huge gap of quality between the two. Yet, both passed. Why so? I was told, because one student was from "regular" program, while the other one from "executive" program. "So the executive program should not be as tough as the regular program". Fine. But I was curious: would they hold identical certificate? To my surprise, the answer was: yes.

I usually don't care with how people gets their jobs. If two persons with different quality end up in the same workplace, do the same thing, and get paid the same amount, I say: none of my business.

But this one is a slightly different problem. It involves maintaing the standard quality of our graduates. I would feel bad to let students leave unprepared for job market. In addition, I don't want the market to perceive that we produce graduates with low quality.

It's happening, unfortunately. I hope this is not simply because we desperately need to raise money and have to sacrifice quality.

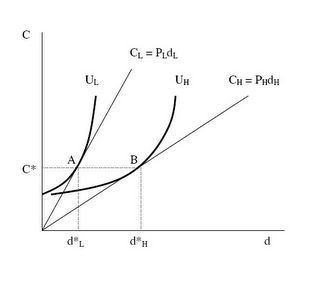

Thinking about it a little further, this situation is not only harmful to the department/university itself, but also to the students, and to the employers. A prospective student of the regular program would think twice: why should I work harder than some other students, if we would all get exactly the same labels? Below is a brief explanation of the effect to the hiring company (see graph above):

Think about a company seeking for two employees with master’s degree in economics. Assume that two of our graduates fill in the application. The company doesn’t want graduates from other university. Our two graduates hold the same diploma. But their quality differs. Graduate L has low probability (P) of failing his assignment, while H has high probability. Both alumnae’s utility curves are shown accordingly. Note that C is “coverage”, or think about wage; and d is “premium” or, for that matter, effort required from the employee. Don’t over-interpret “effort”. It simply means, “If you are not good enough, then you should work harder to be in par with the other – if you demand equal wage”.

The company system goes like this: the more likely you are to fail your task, the more effort you should undertake, and we will pay you accordingly. Obviously from employee’s point of view, less d and more C is preferable – hence the shape and the direction of the utility curves.

If the company can clearly separate between the “low-risk” and “high-risk” employees, it can require different effort levels. For a given wage level, therefore, the equilibrium is A for the good graduate and B for the worse graduate. However, many times, companies fail to identify which one is which – especially when their diplomas are identical. So, since both types prefer A to B, the former will be chosen by both. In this case, the company will make zero "profit" with L-type and negative profit with H-type. If the company wish to prevent any H-type (whichever graduate it turns out) to move to point A, and therefore implements a single rate (d*LH), it will make profit at the cost of low-risk employees.

On the other hand, the good graduate is surely disadvantaged by the situation. With the same effort level with the worse graduate, but with higher quality, he is underpaid (or put differently, the worse graduate is overpaid).

In plain words: moral hazard is at play. And maybe adverse selection as well.